(Drivebycuriosity) - The US earning season is in a full gear. Companies are reporting their profits & revenues from the first quarter 2015. According to Reuters the reported profits are better than analysts had expected (finance): Seventy percent of S&P 500 companies are beating analysts' expectations for earnings so far and first-quarter earnings have risen 0.02% from a year ago. On April 1, analysts' consensus forecast was for a 2.9 percent profit decline. Bespoke Investment wrote on April 24 "so far this earnings season, 67% of the companies that have reported have beaten consensus bottom-line earnings estimates. For top-line revenues, 52% of companies have beaten estimates" (bespoke).

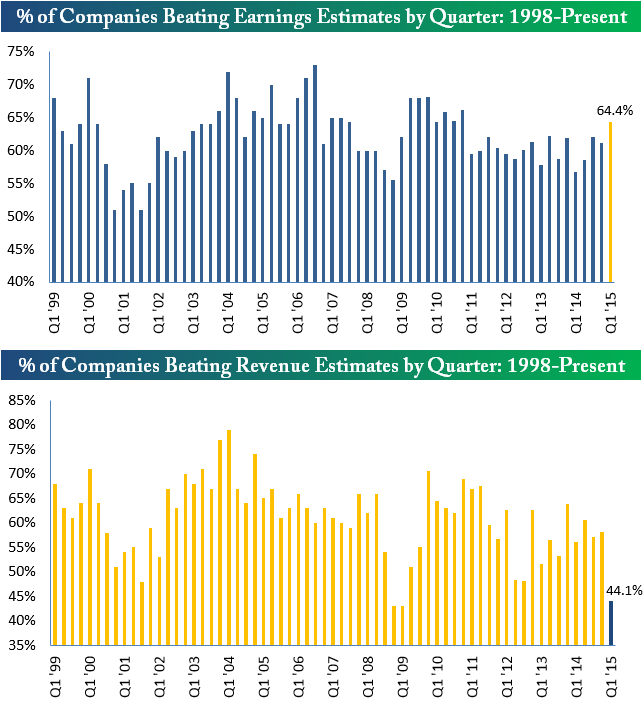

It seems the analysts have been too pessimistic and underestimated the company`s capability to squeeze out rising profits even in a sluggish economic environment. These under-estimates are not new. Since at least 1999 the majority of US companies have been beating the analyst`s profit expectations, around 60% on average (bespoke).

Why do analysts underestimate the company numbers quarter for quarter? There is definitely a negative bias. It seems analyst are following the pessimistic Zeitgeist. Negative news & predictions are en vogue. The media get more readers (and clicks) when they deliver negative news. Maybe analysts try to be popular and deliver pessimistic predictions to please their employers and customers (fund managers).

No comments:

Post a Comment